An unyielding Byju Raveendran on Thursday said his investors were not without blame for the edtech icon’s meltdown, asserting they had aggressively backed him during its era of expansion and acquisitions, but had “all run away” at the first sign of trouble.

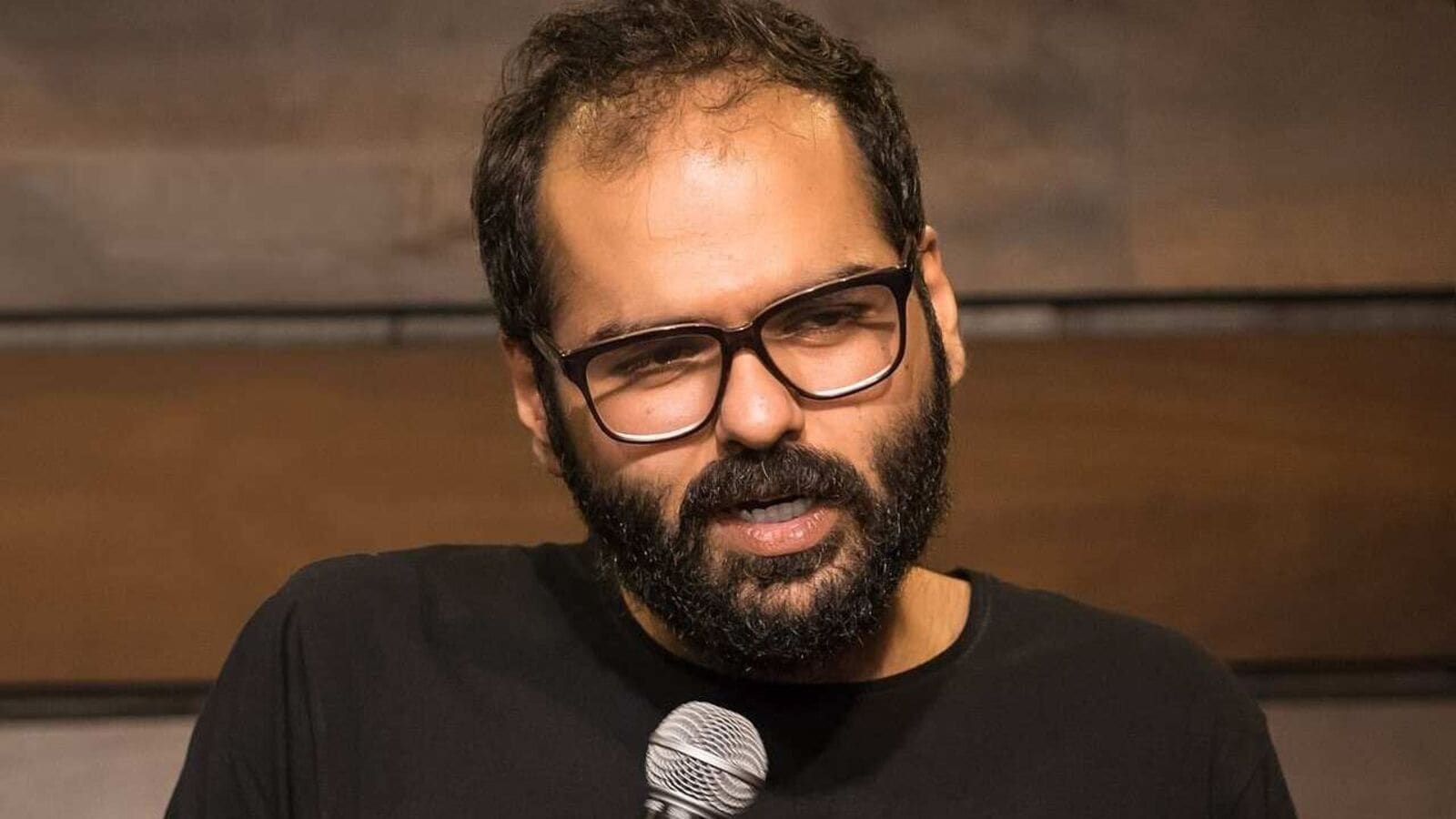

“Investors were asking for that (a change in management) without a plan,” Raveendran told journalists from his residence in Dubai. “Since the markets turned in December 2021, the only people who have been putting money in the company is us,” the edtech’s founder said, insisting he was still the best hope for the startup. He was responding to a question on whether in hindsight he should have given up control of the company to salvage its value.

In February, Byju’s top investors such as Sofina, Peak XV, Prosus and General Atlantic had moved court to oust Raveendran citing mismanagement and oppression of minority rights. Since then, the company has been admitted into bankruptcy.

The investor consortium did not immediately respond to Mint‘s requests for comments on Thursday evening.

“Investors didn’t care about students or parents, they just wanted me to create a $100 billion company,” he said.

‘Fled’ claims false

Raveendran was speaking to journalists from his Dubai residence. He disagreed with the characterization that he had “fled” to Dubai, and claimed that he would be back in India after his court trials to start another edtech, which he would run “at half the cost”.

Raveendran said he moved to Dubai for his father’s treatment. About the personal state of his life, he said after two boys, he was now a father to a four-month old baby girl. Describing his state of mind as “positive”, he said he was still excited about getting back to teaching. His biggest skill was that he could change the mind of students in five minutes—”about how they think about learning”.

Every decision at Byju’s was taken with the consent of all investors, he said.

“The most encouragement for an acquisition I got was from Whitehat Jr. and on the contrary, the most resistance I got from the board was for Aakash acquisition,” Raveendran said. For context, Aakash is now seen as the only shining star in the Byju’s universe of 26 acquisitions. Whitehat Jr. was among the first of its acquisitions to sour.

Raveendran said if he had the benefit of experienced investors such as Mohandas Pai at the beginning, he may not have made mistakes.

“We overestimated the potential growth … and being pioneers in the sector globally, we entered a lot of markets together,” Raveendran said, arguing that the downfall of Byju’s was largely due to mistiming the market and the debt taken by the company.

Byju’s is facing multiple litigations from lenders and investors. Lenders have sought repayment of the $1.2 billion loan he took in November 2021. Investors have sought to preserve their rights in Think & Learn, while some like Qatar Investment Authority have sought a court ruling asking details of Raveendran’s personal assets.

Raveendran went on to claim that although the value of parent entity Think & Learn is now down to zero, the 26 subsidiaries of Byju’s including Aakash Education Services and Great Learning cumulatively report ₹5500 crore in ARR, even now. Mint was not able to independently verify this. At the peak of the business in 2021, the company claimed to be making ₹10,000 crore in revenues and had more than 85,000 employees, including teachers on its platform.

The grounding of business

Confessing for the first time since the crisis started unfolding at the company that was once valued at $22 billion, Raveendran said the core business is currently down to zero. “At present, there are no revenues in the core business,” he said.

According to him, the consolidated numbers, given the revenues of its various subsidiaries, add up to more than ₹5,000 crore. “These subsidiaries have been seeing growth in student sign ups and have been running well,” he added.

Claiming he would make a comeback, Raveendran said that if people shut down Think & Learn, he would still find ways to teach.

Calling it an effort to relaunch and revive, Raveendran said the founders intend to stay in the edtech business, and will likely rebound in a different avatar.

On the shareholding in Aakash, Raveendran appeared to suggest that while Manipal group founder Ranjan Pai owned 40%, the remaining 60 percent is held by the parent company Think and Learn Pvt. Ltd.

To be clear, there are contractual milestones pending in the Aakash transaction.

Raveendran also said that this would play out only after the last tranche of share swaps by Blackstone and the Chaudhary family. While the Chaudhrys have an 18% stake remaining in Aakash, Blackstone still holds a 12%.

The missing money

The $533 million which was at the centre of contention at edtech major has all been set off against the possible expenses the company had to incur over the next two years, he said. “This capital was used as a guarantee for these payment commitments we made,” Raveendran said, explaining how the money has been used up and hence out of bounds for the Term Loan B (TLB) lenders.

In a US court filing last week, Raveendran confirmed the $533 million could not be made available to the TLB lenders, as it had been committed against future expenses, a reversal from the previous stand that the money was kept safe overseas.

Resignation of auditors:

Brushing aside allegations of inability to access data and complete auditing in time that Deloitte Touche Tohmatsu India made in June 2023 while resigning as Byju’s statutory auditor, Raveendran said it was a collective and conscious decision of the company to not grant access to Deloitte as they were unable to complete audit in given timelines. “We didn’t want them to start the audit, because they took 12 months extra the first time around. So, it was a combined decision from everyone,” said Raveendran.

Its second auditor, BDO too, resigned earlier this year, citing concerns over financial and governance issues.

Catch all the Business News , Corporate news , Breaking News Events and Latest News Updates on Live Mint. Download The Mint News App to get Daily Market Updates.

MoreLess

Leave a Reply